Friday

Oct092009

The Gold Standard and The Great Depression

Friday, October 9, 2009 at 3:17PM

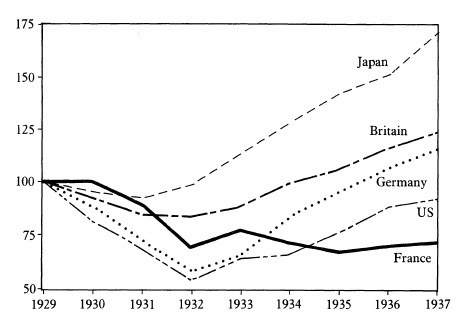

Friday, October 9, 2009 at 3:17PM Although he buried it after a lot of smug mockery of the WSJ, Krugman posted a nice infographic that shows how the world's major economies began to recover from the great depression. The implication is that the first economies to bounce back were the first to ignore the gold standard.

Reader Comments (4)

save your future by saving your wealth physically best choice is gold

Thanks for the great reading, we buy gold in a recession. I will pass this on to our ira clients to read

I find your site very interesting. This information is interesting in that it shows that the "interconnectivity" or "globalization" of the world economy in the 1930's when the gold standard tended to hinder the world economies overall. This is seen today with the interconnectivity and globalization of the world economy where the same thing is occurring, to the extent that there is "interconnectivity" between nations it can be manipulated by specific economies to "affect the others" that would not be the case if each nation set it's own national economic policy. This can be manipulated for specific benefit to some and detriment to others and by design.

One of the things notable in the "interconnectiveness" of the world economy due to the gold standard in the 1930's and seen now per use of the G-20 financial groups, the IMF, and the World Bank, is the use of "interconnectivity" by some to "control" and thus affect others involved in the "interconnection". What is also been seen is the same current "interconnectiveness" of the world economy also detrimenting the world economy as well as individual nations.

This appears to me that this is indicative of a possible use of all sorts of "interconnectedness socially", from social sites to other "interconnections" of social, political and economic alliances, and groups. And it appears important to understand the possible negative uses for this interconnectedness especially by governments vis a vis others for use. As well as others in positions to possibly use and abuse the interconnectiveness itself.

Thanks for the information, we will add this story to our blog, as we have a audience in the

gold sectors that loves reading like this"

Gold

Wonderful post... Very informational and educational as usual!

Acai Optimum